how to declare mileage on taxes

To use this method multiply your total business miles by the IRS Standard Mileage Rate for. Ad For Simple Returns Only File Free Now Even When An Expert Does Your Taxes.

Creating A Mileage Log For Taxes Data Intelligence

For instance lets say you drive 12000 miles in a year 5000 of which were for work.

. Use Form 1040X to amend a federal income tax return that you filed before. The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the deductible. You need to keep track of your total number of miles that you drove during the year and the total number of miles you drove.

To do this you need to itemize your deductions instead of claiming the standard deduction. This is the easiest method and can result in a higher deduction. How to Claim Mileage On Your Taxes.

The standard mileage rate is easy to calculate. Several state lawmakers have an idea to save money and are wanting Governor Lee to declare a. Ad For Simple Returns Only File Free Now Even When An Expert Does Your Taxes.

IRS STANDARD MILEAGE RATE. By Feb 28 2022. Make sure you check the box at the top of the form that shows which year you are.

To claim mileage deductions for. Heres how to write off mileage on taxes. Make Sure You Qualify for Mileage Deduction.

How to Log Mileage for Taxes in 8 Easy Steps 1. Deduct your mileage expense to lower your taxable income. Add up the mileage for each vehicle type youve used for work.

The IRS Standard Mileage rate is the standard mileage reimbursement rate set by the IRS each year so that employees contractors and employers. Standard IRS Mileage Deduction. Take away any amount your employer pays you towards your costs sometimes called a mileage allowance Approved.

Dashers that opted in to receive their 1099 by Postal Service or did not opt for a delivery method should receive their forms in the mail. If you use the actual expense method to claim gasoline on your taxes you cant also claim mileage. There are two ways to calculate mileage reimbursement.

You can also add your. File On Your Own With Expert Help Or Get A Full Service Experience. If youre self-employed or an independent contractor however you can deduct mileage.

Self-employed individuals will report their mileage on the Schedule C form. In addition to providing the number of miles driven during the tax year youll also need to answer. For example if your only miscellaneous deduction is 5000 of mileage expenses in a year you report an AGI of 50000 you must reduce the deduction by 1000 50000.

TaxSlayer has the right tools at the right price. If you are an employee you cannot deduct gas mileage as an unreimbursed expense on your tax return. File On Your Own With Expert Help Or Get A Full Service Experience.

If youre using the standard mileage rate first calculate the value of your deduction. Determine Your Method of Calculation. Ad Slay your state federal taxes filing with TaxSlayer Join millions slaying their taxes.

You can use this rate to calculate your tax deduction at the end of the year. The standard mileage rate lets you deduct a per-cent rate for your mileage. How to claim mileage on taxes.

The standard mileage deduction. Multiply the standard mileage rate by your total miles driven or determine your actual expenses for the year. If youre claiming a deduction for business mileage youll report it using Schedule C on Form 1040.

9 hours agoRight now in Tennessee drivers pay a state gas tax of 27 cents per gallon. For 2020 tax filings the self-employed can claim a 575 cent. When it comes to mileage tax deductions the self-employed mileage deduction is the largest one available.

By Feb 14 2022. Everything you need to file your taxes.

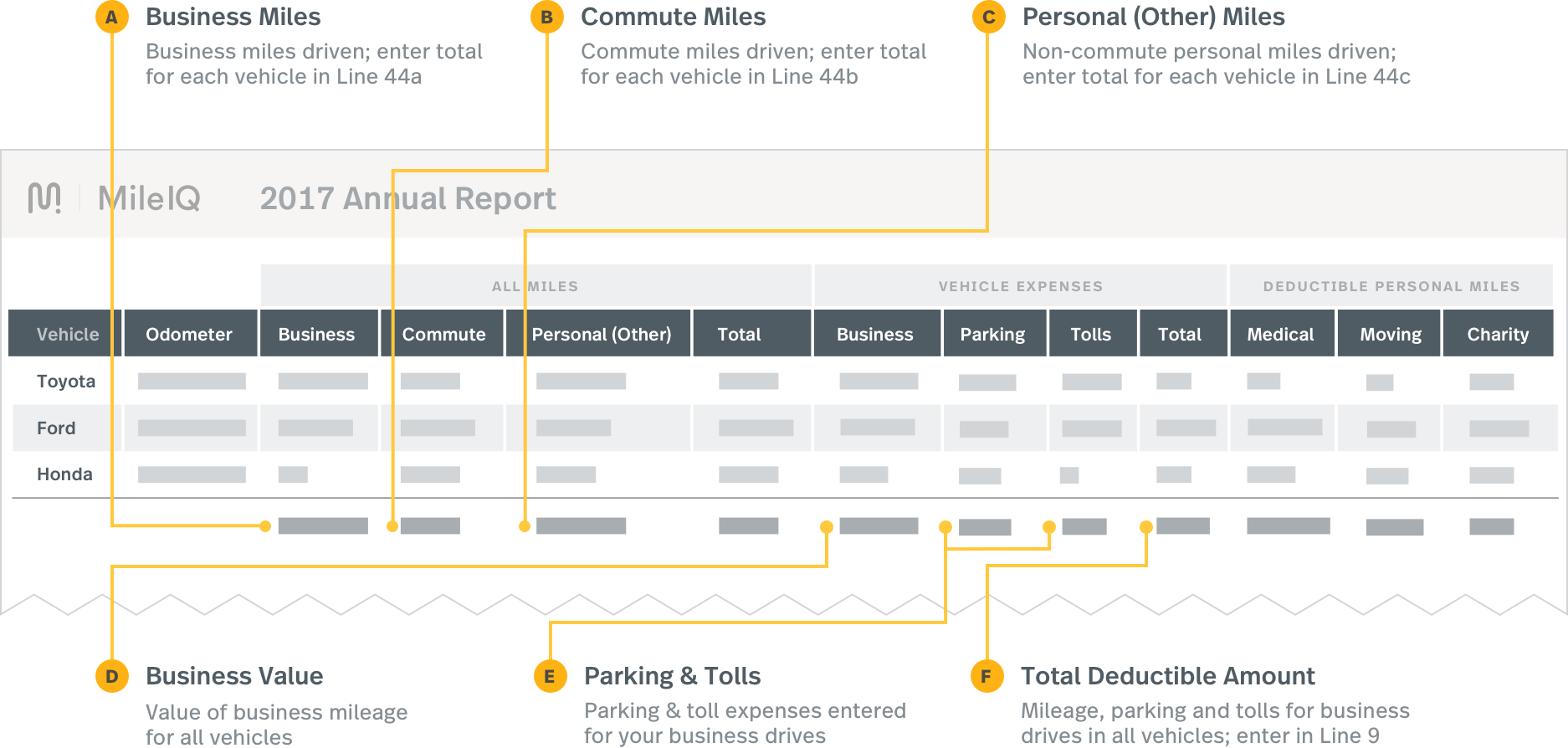

Reporting Mileiq Mileage With Tax Software Mileiq

How Much Tax Does A Sole Trader Pay And How Mazuma

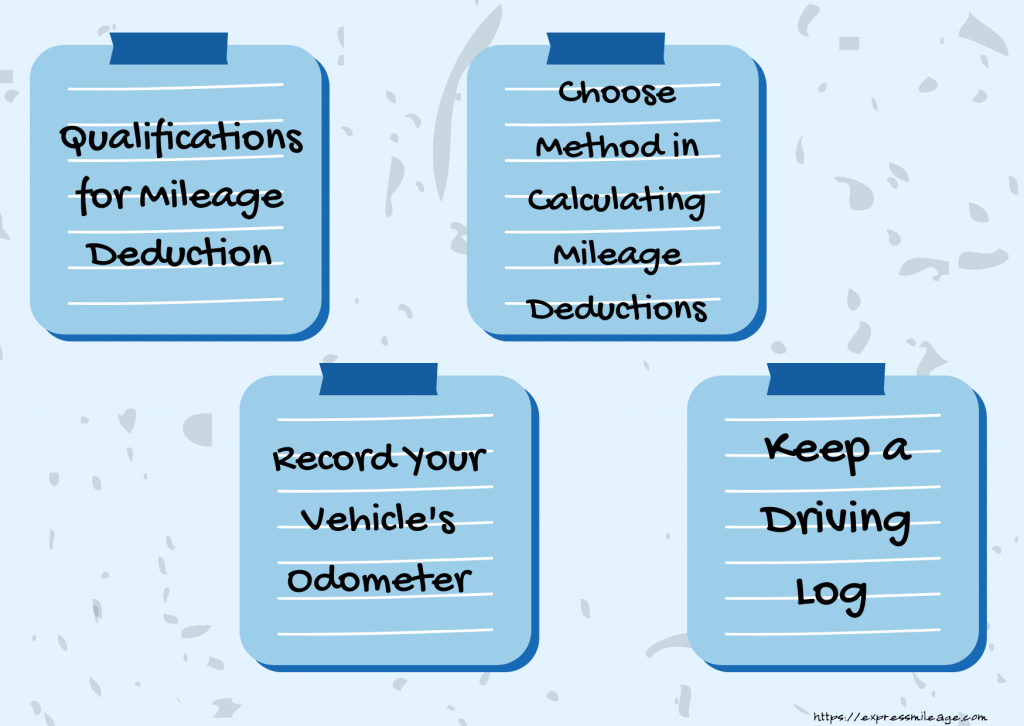

Learn To Log Business Mileage For Taxes Expressmileage

Mileage Tax Deduction Claim Or Take The Standard Deduction

Free Mileage Reimbursement Form 2022 Irs Rates Word Pdf Eforms

How To Claim Mileage And Business Car Expenses On Taxes

![]()

25 Printable Irs Mileage Tracking Templates Gofar

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

What Are The Irs Mileage Log Requirements The Motley Fool

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

25 Printable Irs Mileage Tracking Templates Gofar

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

What Are The Mileage Deduction Rules H R Block

What Records Do You Need To Claim A Vehicle Mileage Deduction

What Business Mileage Is Tax Deductible

![]()

25 Printable Irs Mileage Tracking Templates Gofar

Free Mileage Log Template For Excel

Business Mileage Deduction 101 How To Calculate Mileage For Taxes